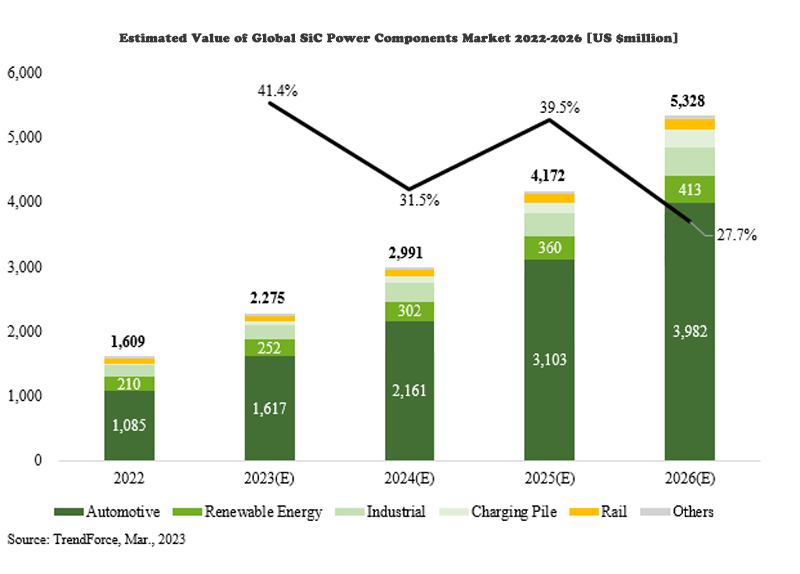

According to a report released by TrendForce Consulting, as Anson, Infineon and other cooperation projects with automobile and energy manufacturers are clear, the overall SiC power component market will be promoted to 2.28 billion US dollars in 2023 (IT home note: about 15.869 billion yuan), up 41.4% year-on-year.

According to the report, the third-generation semiconductors include silicon carbide (SiC) and gallium nitride (GaN), and SiC accounts for 80% of the overall output value. SiC is suitable for high voltage and high current application scenarios, which can further improve the efficiency of electric vehicles and renewable energy equipment system.

According to TrendForce, the top two applications for SiC power components are electric vehicles and renewable energy, which have reached $1.09 billion and $210 million respectively in 2022 (currently about RMB7.586 billion). It accounts for 67.4% and 13.1% of the total SiC power component market.

According to TrendForce Consulting, the SiC power component market is expected to reach $5.33 billion by 2026 (currently about 37.097 billion yuan). The mainstream applications still rely on electric vehicles and renewable energy, with the output value of electric vehicles reaching $3.98 billion (currently about 27.701 billion yuan), CAGR (compound annual growth rate) of about 38%; Renewable energy reached 410 million US dollars (about 2.854 billion yuan at present), CAGR of about 19%.

Tesla has not deterred SiC operators

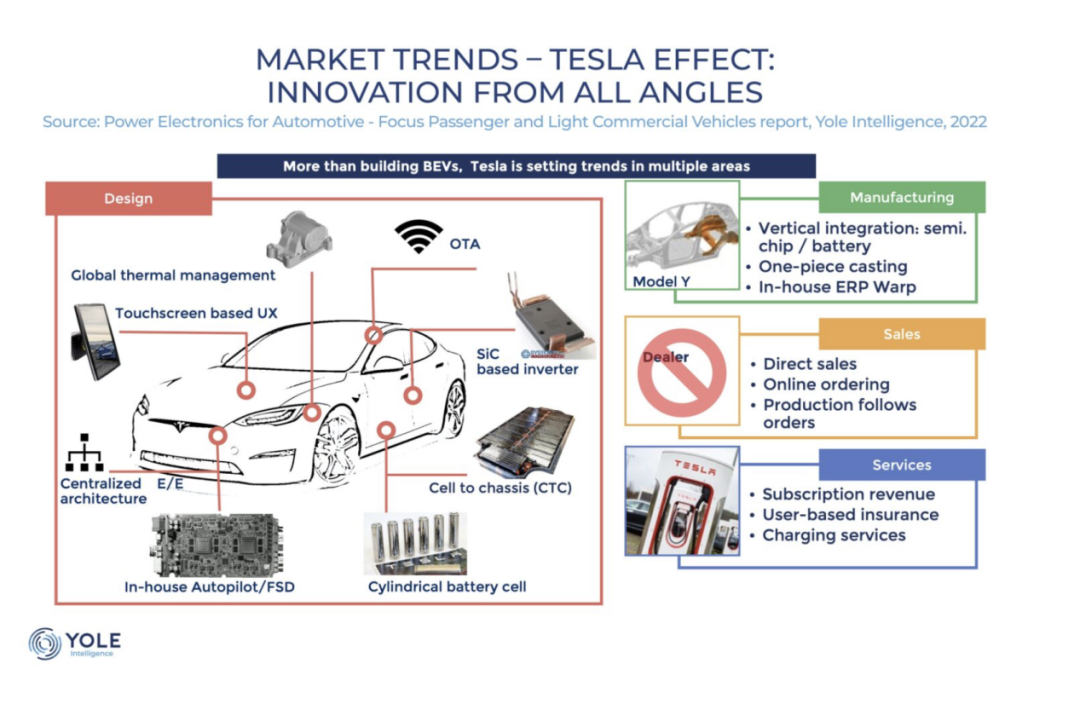

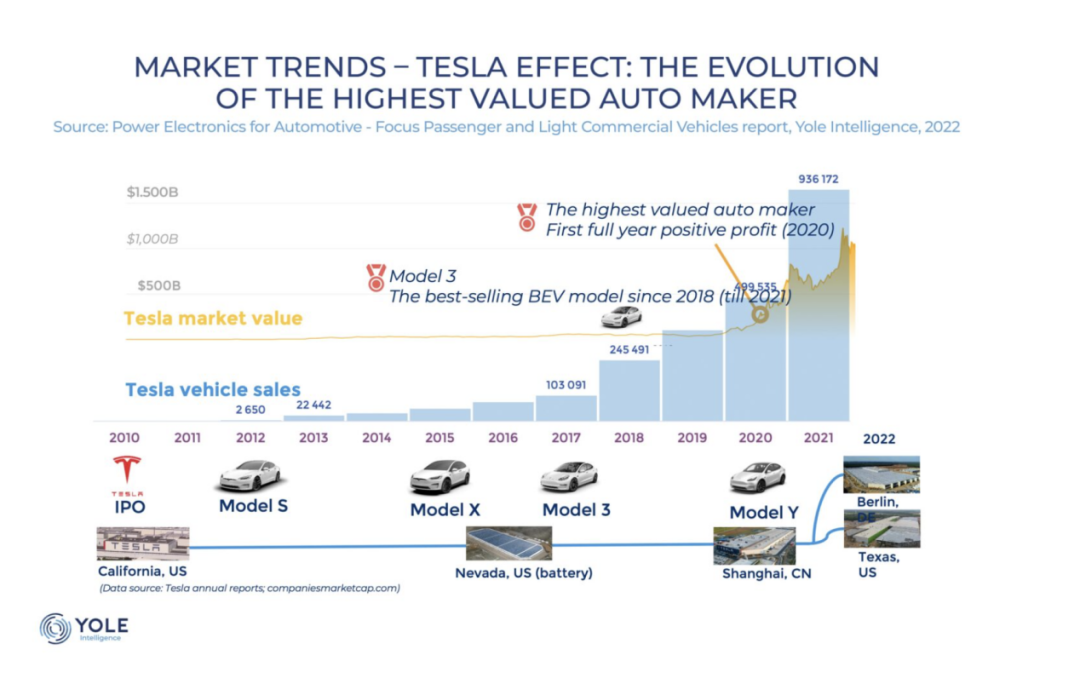

The growth of the silicon carbide (SiC) market over the past five years has largely depended on Tesla, the first original equipment manufacturer to use the material in electric vehicles, and the largest purchaser today. So when it recently announced that it had found a way to reduce the amount of SiC used in its future power modules by 75 per cent, the industry was thrown into a panic, and inventories of the major players suffered.

A 75 per cent cut sounds alarming, especially without much context, but there are a number of potential scenarios behind the announcement – none of which suggest a dramatic reduction in demand for materials or the market as a whole.

Scenario 1: Fewer devices

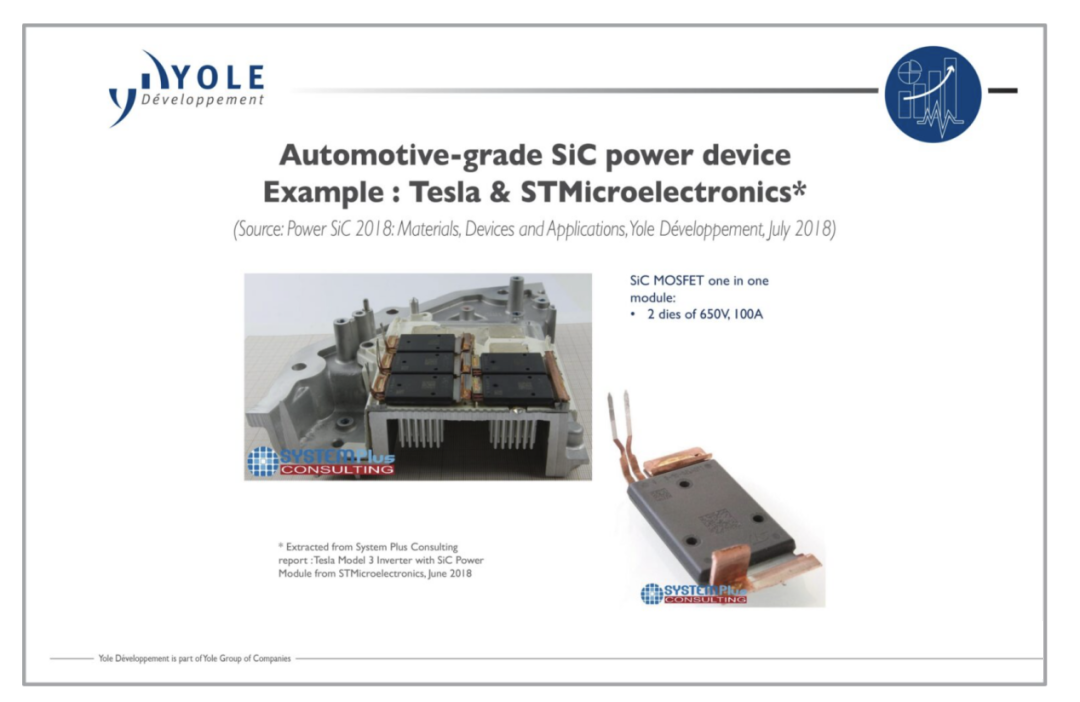

The 48-chip inverter in the Tesla Model 3 is based on the most innovative technology available at the time of development (2017). However, as the SiC ecosystem matures, there is an opportunity to extend the performance of SiC substrates through more advanced system designs with higher integration. While it is unlikely that a single technology will reduce SiC by 75%, various advances in packaging, cooling (i.e., double-sided and liquid-cooled), and channeled device architecture can lead to more compact, better-performing devices. Tesla will no doubt explore such an opportunity, and the 75% figure likely refers to a highly integrated inverter design that reduces the number of dies it uses from 48 to 12. However, if this is the case, it is not equivalent to such a positive reduction of SiC materials as has been suggested.

Meanwhile, other Oems launching 800V vehicles in 2023-24 will still rely on SiC, which is the best candidate for high power and high voltage rated devices in this segment. As a result, Oems may not see a short-term impact on SiC penetration.

This situation highlights the shift in the SiC automotive market’s focus from raw materials to equipment and systems integration. Power modules now play a vital role in improving overall cost and performance, and all the major players in the SiC space have power module businesses with their own internal packaging capabilities – including onsemi, STMicroelectronics and Infineon. Wolfspeed is now expanding beyond raw materials to devices.

Scenario 2: Small vehicles with low power requirements

Tesla has been working on a new entry-level car to make its vehicles easier to use. The Model 2 or the Model Q will be cheaper and more compact than their current vehicles, and smaller cars with fewer features will not need as much SiC content to power them. However, its existing models are likely to retain the same design and still require large amounts of SiC overall.

For all its virtues, SiC is an expensive material, and many Oems have expressed a desire to reduce costs. Now that Tesla, the largest OEM in the space, has commented on prices, this could put pressure on IDMs to reduce costs. Could Tesla’s announcement be a strategy to drive more cost-competitive solutions? It will be interesting to see how the industry reacts in the coming weeks/months…

Idms are using different strategies to reduce costs, such as by sourcing substrate from different suppliers, expanding production by increasing capacity and switching to larger diameter wafers (6 “and 8″). The increased pressure is likely to accelerate the learning curve for players across the supply chain in this area. In addition, rising costs could make SiC more affordable not only for other automakers but also for other applications, which could further drive its adoption.

Scenario 3: Replace SIC with other materials

Analysts at Yole Intelligence are keeping a close eye on other technologies that could compete with SiC in electric vehicles. For example, grooved SiC offers higher power density – will we see it replace flat SiC in the future?

By 2023, Si IGBTs will be used in EV inverters and are well positioned within the industry in terms of capacity and cost. Manufacturers are still improving performance, and this substrate may show the potential of the low-power model mentioned in scenario two, which makes it easier to scale up in large quantities. Maybe SiC will be reserved for Tesla’s more advanced, more powerful cars.

GaN-on-Si shows great potential in the automotive market, but analysts see this as a long-term consideration (over 5 years in inverters in the traditional world). While there has been some discussion in the industry around GaN, Tesla’s need for cost reduction and mass scale-up makes it unlikely that it will move to a much newer and less mature material than SiC in the future. But can Tesla take the bold step of adopting this innovative material first? Only time will tell.

Wafer shipments affected slightly, but there may be new markets

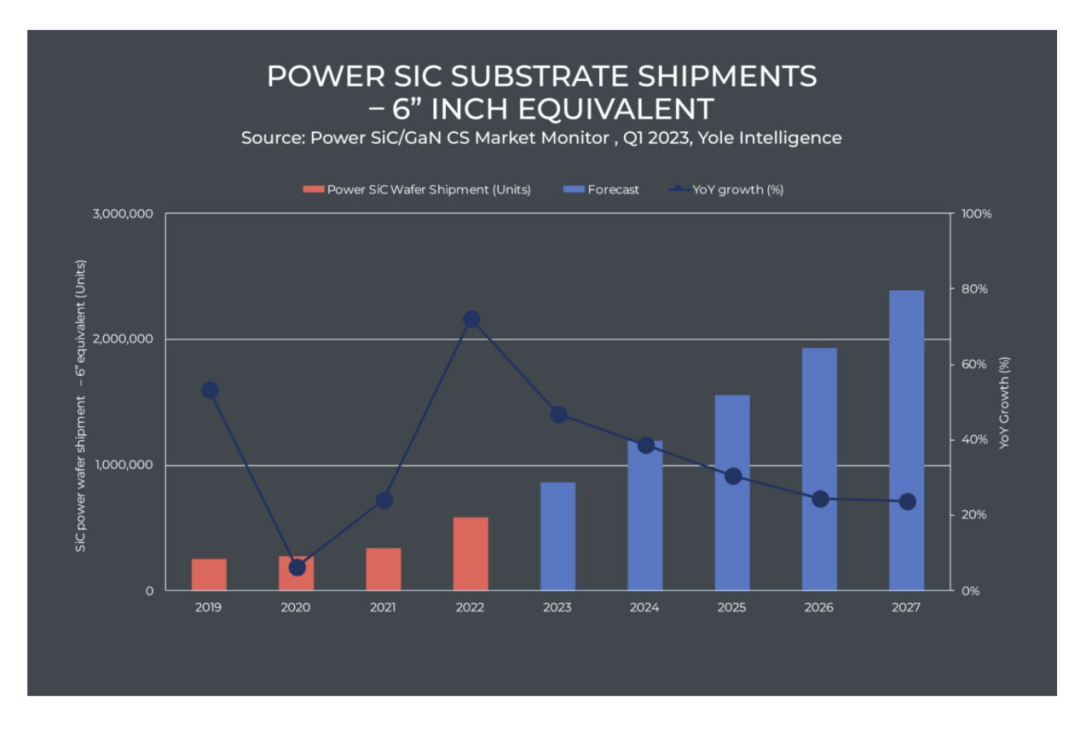

While the push for greater integration will have little impact on the device market, it could have an impact on wafer shipments. Although not as dramatic as many initially thought, each scenario predicts a decline in SiC demand, which could affect semiconductor companies.

However, it could increase the supply of materials to other markets that have grown along with the auto market over the past five years. Auto expects all industries to grow significantly in the coming years — almost thanks to lower costs and increased access to materials.

Tesla’s announcement sent shockwaves through the industry, but on further reflection, the outlook for SiC remains very positive. Where does Tesla go next — and how will the industry react and adapt? It’s worth our attention.

Post time: Mar-27-2023